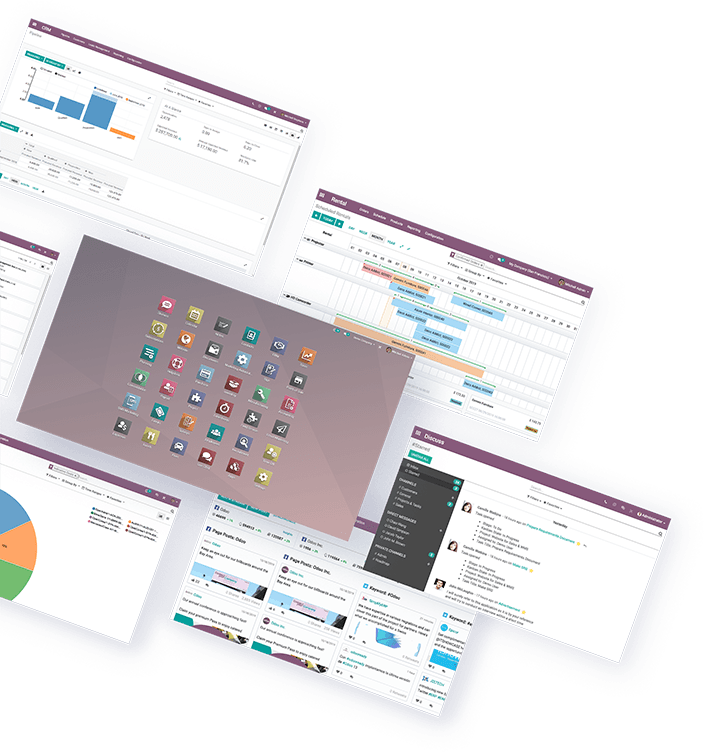

Insurance ERP software

Insurance ERP software, also known as Enterprise Resource Planning, has become essential for insurance companies to streamline their operations and improve efficiency. With features tailored specifically for the insurance industry, ERP software integrates various functions and processes such as policy administration, claims management, underwriting, financial management, and customer relationship management. This comprehensive system enables insurers to automate manual tasks, ensure data accuracy, and enhance collaboration among different departments.

Common Problem Insurance Companies Face.

- Lack of automation: Manual tasks and outdated systems can lead to time-consuming processes, data entry errors, and a lack of real-time information

- Ineffective customer service: Insufficient customer service processes and systems can lead to poor customer experiences, including long wait times.

- Ineffective fraud detection: Insurance fraud is a significant concern, and companies need robust systems and processes to detect and prevent fraudulent activities.

- Without robust analytical capabilities, insurance companies may struggle to gain valuable insights from their data, hindering strategic decision-making and competitive advantage.

- Poor vendor management: Insufficient vendor management processes and tools can result in difficulties in tracking vendor performance, ensuring contract compliance, and managing relationships effectively.

- High operational costs: Insurance companies often struggle with high operational costs due to complex processes, manual paperwork, and outdated systems.

- Regulatory compliance: Insurance companies must adhere to strict regulatory requirements, making compliance a complex and resource-intensive task.

Key Benefits of Using ERP Insurance Software

- Automation and productivity: Insurance ERP software automates routine tasks, improves data accuracy, and enhances productivity by eliminating manual data entry and reducing human errors

- Enhanced customer service: ERP systems offer comprehensive customer relationship management tools, enabling insurers to provide better service through quick responses, personalised interactions, and access to accurate information.

- Improved risk assessment: Insurance ERP software provides advanced analytics and reporting capabilities, enabling insurers to assess risks more accurately, make informed underwriting decisions, and mitigate losses.

- Advanced analytics and insights: ERP platforms offer robust analytics and reporting capabilities, enabling insurance companies to gain valuable insights from their data.

- Effective vendor management: ERP systems offer vendor management features, helping insurance companies track vendor performance, ensure contract compliance, and manage relationships more efficiently.

- Cost reduction: ERP systems help streamline processes, automate tasks, and eliminate manual paperwork, leading to cost savings for insurance companies.

- Regulatory compliance: Insurance ERP software incorporates compliance features and facilitates adherence to regulatory requirements, ensuring insurance companies meet industry standards.

Modules of Insurance ERP Software

The Mobile App module provides a mobile interface for accessing and managing Odoo ERP functionalities on smartphones and tablets. It enables insurance professionals to stay connected and perform key tasks while on the go.

The Policy Management module in an ERP system helps insurance companies streamline and automate the entire policy lifecycle. It facilitates efficient policy creation, underwriting, rating, and policy administration

The HR Management module in an ERP system offers insurance companies a comprehensive solution to manage their human resources effectively.

The Contract Management module in an ERP system simplifies and streamlines the administration of insurance contracts. It enables the creation, tracking, and management of contracts throughout their lifecycle, from initial negotiation to renewal or termination.

The Subscription Management module in an ERP system assists insurance companies in managing various types of insurance subscriptions. It enables insurers to track and manage policyholder subscriptions, handle billing and invoicing, and automate subscription renewals.

The Document Management module in an ERP system centralizes and streamlines the management of insurance documents. It provides a secure repository for storing and organizing policy documents, claims records, customer correspondence, and other important documents.

The Human Capital and Transaction Management module in an ERP system combines the management of human resources and transactional processes in insurance operations. It facilitates end-to-end automation of various insurance processes, including new business applications, policy endorsements, claims processing, and commission management.

Should I Choose Insurance ERP software for my Insurance Company?

Choosing Insurance ERP software for your insurance company offers numerous benefits. It streamlines processes, automates tasks, improves data accuracy, and provides real-time insights for informed decision-making. With integrated features such as claims management, policy administration, and financial management, it enhances collaboration, customer service, and business agility. Evaluate your needs and budget to make an informed decision on whether Insurance ERP software is the right choice for your company.

AnaConEx Solutions: Revolutionising Insurance Operations with Odoo ERP

AnaConEx Solutions stands out as a leading implementer of Odoo ERP software for the insurance industry. With our extensive expertise and specialisation in Odoo, we offer unparalleled solutions tailored to the unique requirements of insurance companies. AnaConEx Solutions has earned a reputation for being the best Odoo implementer, known for our successful and seamless implementations. Our team of skilled professionals possesses in-depth knowledge of both the insurance domain and the Odoo ERP platform, enabling them to design and configure the software to align perfectly with insurance business processes.

Connect with Our Directors

Tanveer Ahmad