Driving Banking Success with Odoo ERP for the Banking Industry

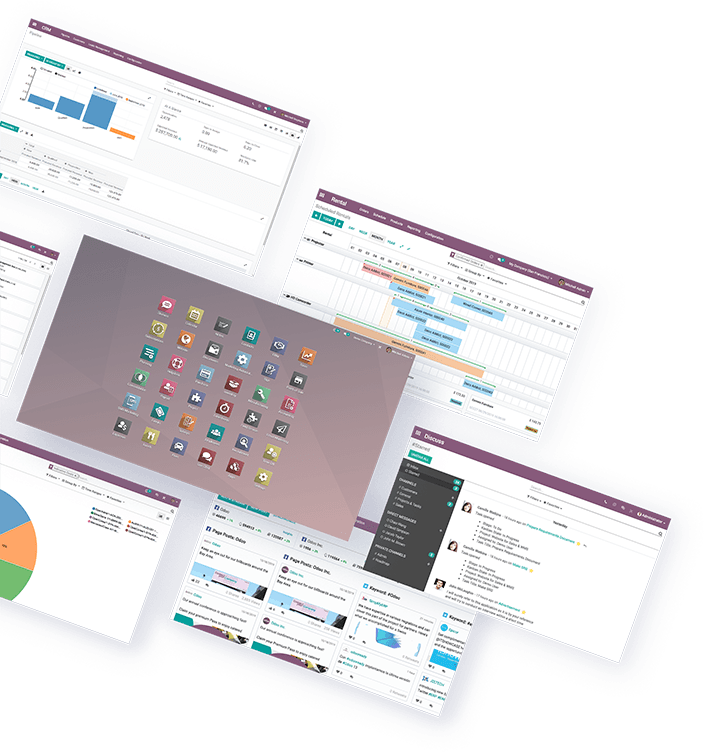

In the fast-paced world of banking today, keeping things running smoothly, securely, and without any hiccups is absolutely vital. So, here’s the deal – the Odoo ERP system, including Odoo ERP for the Banking Industry, is stepping up big time in the banking industry. We’re here to craft solutions that are tailor-made for tackling those everyday challenges that financial institutions like yours grapple with.

So, let’s roll up our sleeves and dive deep into how Odoo ERP can weave its magic, revolutionizing the way you handle your banking operations. It’s pretty impressive,

Common Problems in the Banking Industry

- Protecting sensitive customer data and financial information is an ongoing challenge.

- Meeting regulatory requirements and maintaining compliance is a constant struggle.

- Traditional systems may struggle to adapt to the bank's growth.

- Providing exceptional service while managing costs can be a balancing act.

- Identifying and mitigating risks in real-time is critical.

- Generating accurate and timely reports for decision-making can be a hassle.

- Outdated technology can hinder innovation and competitiveness.

- Optimizing resource allocation is a complex task.

- Managing costs without compromising service quality is essential.

Key Benefits of Odoo Banking ERP Software

- Robust security features to safeguard sensitive data.

- Built-in compliance tools to streamline adherence to industry regulations.

- Automate routine tasks to improve operational efficiency.

- Easily scale your system to accommodate growth and evolving needs.

- Provide exceptional service with integrated CRM tools.

- Real-time risk assessment and mitigation capabilities.

- Generate insightful reports for data-driven decision-making.

- Keep pace with technology advancements with regular updates.

- Efficiently allocate resources and reduce wastage.

- Achieve cost control through streamlined processes.

Our Module for Odoo Banking ERP Software

- Efficiently manage and track your bank’s assets, including financial instruments and investments.

- Monitor asset performance and make informed decisions to optimize returns.

- Enhance customer service and satisfaction with a robust CRM system.

- Keep detailed customer records, track interactions, and personalize services to build strong relationships.

- Proactively identify, assess, and mitigate risks in real-time.

- Utilize advanced analytics and modeling tools to strengthen risk management strategies.

- Ensure adherence to industry regulations and compliance requirements effortlessly.

- Automate compliance checks, generate reports, and minimize compliance-related risks.

- Streamline internal processes, automate routine tasks, and reduce operational bottlenecks.

- Optimize resource allocation to improve overall efficiency.

- Generate insightful reports and analytics to support data-driven decision-making.

- Get a full view of your bank’s performance for smarter strategic choices.”

- Seamlessly scale your operations to accommodate growth and market changes.

- Ensure your bank’s systems can expand without compromising performance or security.

A CASE OF SUCCESS: CITIBANK

Citibank has seen some major benefits since they started using Odoo ERP. They’ve upped their game in compliance, risk management, fraud detection, saved on costs, and become much more efficient.

Here are some specific examples of the benefits that Citibank has realized:

- They reduced the time it took to onboard new customers from 2 weeks to 2 days.

- They improved their fraud detection rate by 10%.

- They saved $1 million in compliance costs.

- They increased their efficiency by 15%.

Citibank is a large and complex organization, so the implementation of Odoo ERP was not without its challenges. However, the benefits that they have realized have been significant.

If you are a bank that is looking to improve your compliance, risk management, fraud detection, cost savings, and efficiency, then Odoo ERP is a valuable tool that you should consider.

Should You Implement Odoo Banking ERP Software?

- Does your company aim to optimize its banking operations, reduce manual processes, and increase efficiency?

- Is safeguarding sensitive customer data and financial information a top priority for your organization?

- Are you in search of a solution that makes complying with industry regulations a breeze and minimizes the risks associated with compliance?

- Is your company all about going the extra mile to deliver exceptional service and build lasting customer relationships?

- Is scalability essential for accommodating the expansion of your banking operations seamlessly?

- Are you all about keeping costs in check while making sure you're still delivering top-notch service to your customers?

Conclusion

Staying ahead in today’s ever-changing banking landscape is crucial, isn’t it? That’s where Odoo ERP steps in for the banking industry, ready to propel your success by tackling those typical industry hurdles, boosting efficiency, and guaranteeing compliance.

AnaConEx Solution: Your Odoo Banking ERP Software Consultant

Anaconex solution is your trusted partner in implementing Odoo ERP solutions for the banking industry. You’re in good hands with our team of seasoned consultants. They’ve got the know-how, and our track record is the evidence that speaks for itself.. We’ll be right there with you, making sure the transition to a more efficient and secure banking operation is smooth sailing all the way.

Feel free to get in touch with us today, and we’ll walk you through the incredible ways Odoo ERP can breathe new life into your banking institution. Let’s explore the potential together!

Our Clients

Connect with Our Directors

Tanveer Ahmad